BTC Price Prediction: $130K Target in Sight as Technicals and Sentiment Align

#BTC

- Technical Strength: BTC price above 20-day MA with MACD bullish divergence

- Institutional Catalyst: MicroStrategy/Metaplanet expanding holdings amid yield-seeking demand

- Macro Alignment: Trade deal reduces risk-off sentiment; Fundstrat sees structural bullishness

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

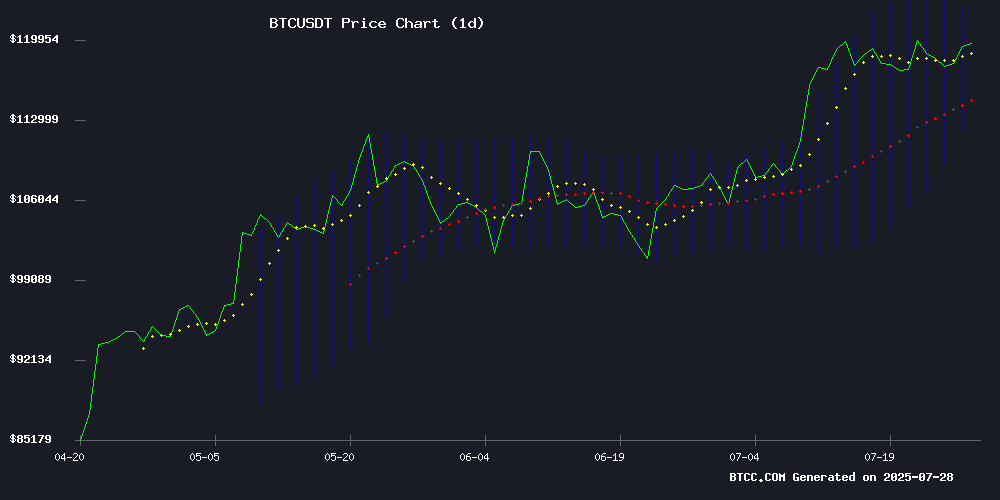

According to BTCC financial analyst Emma, Bitcoin (BTC) is currently trading at $119,617.09, above its 20-day moving average (MA) of $117,935.71, indicating a bullish trend. The MACD histogram shows a positive crossover, with values at -1841.8285 (MACD line), -3869.4763 (signal line), and 2027.6478 (histogram), suggesting upward momentum. Bollinger Bands reveal price hovering near the upper band at $121,592.64, signaling potential overbought conditions but also strong buying interest. Emma notes that if BTC holds above the middle band ($117,935.71), further gains toward $130,000 are likely.

Market Sentiment: Institutional Demand Fuels BTC Rally

BTCC financial analyst Emma highlights bullish market sentiment driven by institutional adoption. Metaplanet's expansion to 17,132 BTC and MicroStrategy's $2.8B preferred stock offering for bitcoin purchases reflect strong demand. The U.S.-EU trade deal has boosted risk appetite, while Fundstrat views macro risk reduction as a tailwind. News of a dormant whale moving $9B BTC without market disruption underscores resilience. Emma cautions that debates around early holders' faith and IMF scrutiny on El Salvador may introduce volatility, but overall, the narrative remains constructive for BTC.

Factors Influencing BTC’s Price

Bitcoin Surges to $120,000 as U.S.-EU Trade Deal Boosts Risk Appetite

The S&P 500 breached 6,400 following a U.S.-EU agreement to reduce tariffs to 15%, sparking a broad market rally. Bitcoin capitalized on the risk-on sentiment, climbing to $120,000 for the first time in nearly two weeks—just $3,080 shy of its all-time high.

Futures tied to major indices jumped, with Dow contracts rising 180 points (0.4%). The rally gained momentum after the White House confirmed the trade resolution, averting threatened 30% tariffs on EU imports. bitcoin had previously oscillated between $114,000 and $119,000 before the breakout.

Investors now brace for a high-stakes week featuring tech earnings, Fed policy signals, inflation data, and President Trump's August 1 tariff deadline. Last week’s record closes for the S&P 500 (14th this year) and Nasdaq (15th) set the stage for continued volatility.

Metaplanet Expands Bitcoin Holdings to 17,132 BTC Amid Surging Investor Interest

Metaplanet, the Tokyo-listed firm rapidly emerging as Asia's most aggressive corporate Bitcoin accumulator, purchased an additional 780 BTC on July 28. The ¥13.67 billion ($92.93 million) acquisition at ¥17.52 million ($119,136) per Bitcoin brings its total holdings to 17,132 BTC—a 28% monthly increase from its 13,350 BTC position in June.

Trading volume for Metaplanet shares on the Tokyo Stock Exchange doubled to ¥1.86 trillion ($12.65 billion) in June, reflecting heightened market enthusiasm for its Bitcoin-centric strategy. The company has added over 13,000 BTC in Q3 alone, funded through capital raises and bond redemptions.

Bitcoin Price Gears Up for Fresh Rally After Tight Range

Bitcoin shows signs of renewed bullish momentum as it breaches key resistance levels. The cryptocurrency climbed past $118,500, establishing a foothold above the 100-hour Simple Moving Average. A decisive break above the $120,500 level could signal further upside potential.

Technical indicators suggest growing strength. The BTC/USD pair broke through a bearish trend line at $118,300 on Kraken's hourly chart, with the price now consolidating above the 23.6% Fibonacci retracement level of its recent swing from $114,733 to $119,795. Market participants are watching the $120,000 and $120,500 resistance levels as potential springboards for the next leg up.

MicroStrategy Expands Bitcoin Holdings with $2.8B Preferred Stock Offering

MicroStrategy's relentless Bitcoin accumulation strategy has pushed its holdings to 607,770 BTC, valued at $71.8 billion. The business intelligence firm now boasts $28.17 billion in unrealized profits since its first purchase in 2020, maintaining a dollar-cost average below today's $118,533 spot price.

The company's latest $2.8 billion 'stretch' preferred stock offering fuels its asymmetric bet on cryptocurrency. MicroStrategy shares currently trade at a 76% premium to Bitcoin net asset value, reflecting market confidence in Michael Saylor's conviction play.

Corporate balance sheets are becoming the new institutional on-ramp for digital asset exposure. MicroStrategy's dashboard reveals methodical accumulation during both rallies and consolidation periods, with a 64.58% cumulative gain since inception.

Did El Salvador Fake Bitcoin Purchases to Secure IMF Funding?

El Salvador's bold Bitcoin experiment faces scrutiny after IMF documents reveal a stark discrepancy between its publicized crypto strategy and private financial maneuvers. The government, which had pledged daily Bitcoin purchases since November 2022 and promoted its growing reserves through platforms like Nayib Tracker, abruptly halted acquisitions in February 2025—weeks after securing a $1.4 billion IMF lifeline.

President Bukele's administration had positioned the country as a crypto pioneer, launching Chivo Wallet, Bitcoin ATMs, and plans for a tax-free 'Bitcoin City.' These high-profile initiatives won praise from crypto advocates as a challenge to traditional finance. Yet behind the fanfare, El Salvador grappled with mounting debt and a widening budget deficit, ultimately accepting strict IMF conditions that appear incompatible with its Bitcoin accumulation claims.

The revelation raises fundamental questions about whether El Salvador's very public Bitcoin strategy served primarily as theater during debt negotiations. With no purchases recorded for five months post-IMF deal, the episode underscores the tension between cryptocurrency evangelism and fiscal reality in developing economies.

Strategy’s Bitcoin-Backed Preferred Stock Offers 9% Yield, Expands to $2B Amid Demand

Strategy (MSTR) is redefining yield investing with its $2 billion Bitcoin-backed "Stretch" Preferred Stock (STRC), which pays a variable 9% dividend. The security aims to maintain a steady $100 share price, blending crypto's growth potential with income stability. Unlike direct Bitcoin exposure, STRC is structured to provide returns backed by bitcoin’s long-term performance rather than short-term volatility.

The company holds $71.7 billion worth of bitcoin against $11 billion in liabilities, creating a substantial buffer for consistent payouts even during market downturns. Historical data shows bitcoin delivering 3%–4% annual returns over any five-year period, with actual averages often higher. Strategy’s approach converts this long-term appreciation into monthly cash FLOW without liquidating crypto reserves.

NYDIG describes STRC as a "high-yield, bitcoin-backed, money-market-style vehicle" designed to trade NEAR par value while offering significantly higher yields than conventional short-term investments. Investor demand has been robust, prompting Strategy to expand the offering from $500 million to $2 billion—a clear signal of growing institutional interest in innovative crypto-financial hybrids.

Bitcoin Projected to Reach $1 Million in 10 Years via ‘Pump and Consolidate’ Pattern

Bitcoin’s bull cycle was prematurely declared over when prices dipped to $75,000 in March 2025, following an all-time high above $100,000. Contrary to expectations, the cryptocurrency has since surged to new peaks, currently trading around $122,800. Market consensus now suggests a seven-figure valuation is inevitable.

Blockware analyst Mitchell Askew predicts Bitcoin will hit $1 million within a decade, arguing that parabolic rallies and severe bear markets are relics of the past. The launch of U.S. spot ETFs has fundamentally altered Bitcoin’s market behavior, creating a more stable growth trajectory. "The days of extreme volatility are behind us," Askew notes, emphasizing institutional adoption as the catalyst for sustained appreciation.

Dormant Bitcoin Whale Moves $9 Billion in BTC, Market Absorbs Shock

A long-dormant Bitcoin whale from the Satoshi era has transferred 80,000 BTC ($9 billion) through Galaxy Digital, marking one of the largest single-entity sales in recent history. The transaction briefly rattled markets, sending BTC prices down 3.5% to $115,000 before bulls staged a rapid recovery.

Market depth proved resilient despite the sale representing 0.4% of Bitcoin's total supply. The swift rebound suggests institutional demand continues to provide strong support levels, with Galaxy Digital's execution demonstrating growing sophistication in handling large crypto transactions.

Bitcoin's price action following the event underscores the cryptocurrency's maturation. Where such whale movements once caused prolonged downturns, the market now demonstrates remarkable absorption capacity—a testament to its expanding liquidity and diversified investor base.

Fundstrat Views Trump's EU Trade Deal as Macro Risk Reduction, Bullish for Bitcoin

President Trump's landmark $1.35 trillion trade agreement with the European Union has drawn attention from crypto markets as a potential macro tailwind. The deal mandates EU purchases of $750 billion in US energy exports, $600 billion in economic investments, and hundreds of billions in military equipment, while establishing uniform 15% tariffs on traded goods.

Fundstrat's Thomas Lee characterized the agreement as removing a critical 'tail risk' for risk assets. Market participants are interpreting the reduction in trade tensions between the US and its largest economic partner as constructive for Bitcoin's role as a macro hedge. The news comes as traders simultaneously monitor developments in US-China tariff negotiations.

Trump emphasized the unprecedented scale of the agreement during announcements, noting American goods will now enter EU markets tariff-free. This development marks a stark reversal from years of escalating trade barriers between the transatlantic allies.

Bitcoin MVRV Pricing Bands Suggest $130K Target, Conditional on Key Support

Bitcoin's recent price action has sparked bullish speculation, with top analyst Ali Martinez pointing to Glassnode's MVRV pricing bands as a potential roadmap to $130,000. The cryptocurrency's current $118,782 valuation sits just below the critical +1.0σ deviation band at $130,756—a level historically associated with market euphoria and potential local tops.

The $110,000 support zone emerges as a make-or-break threshold. Should Bitcoin maintain this level, the MVRV model suggests a clear path toward its upper pricing band. However, any breakdown below this support could invalidate the bullish thesis, underscoring the delicate balance between current momentum and underlying on-chain fundamentals.

Debate Erupts Over Early Bitcoin Holders' Faith Amid Institutional Adoption

Analyst Scott Melker's recent claims about early Bitcoin whales losing confidence have sparked heated debate. His assertion that these holders are selling due to institutional co-option of Bitcoin's original ethos has drawn both support and criticism from the community.

Counterarguments emphasize personal circumstances as the primary driver for sales, with examples like Willy WOO reallocating to infrastructure and PlanB shifting to spot ETFs for convenience. The tension between Bitcoin's anti-establishment roots and its growing mainstream acceptance continues to divide opinion.

Market observers note this philosophical debate coincides with Bitcoin's ongoing institutionalization, as traditional finance entities increasingly embrace the asset class. The community remains split on whether this represents progress or a fundamental compromise of cryptocurrency's founding principles.

How High Will BTC Price Go?

Emma projects a near-term target of $130,000 for BTC, contingent on holding above $117,935 (20-day MA). Key drivers include:

| Factor | Impact |

|---|---|

| Technical Breakout | MACD bullish crossover + upper Bollinger Band test |

| Institutional Demand | MicroStrategy/Metaplanet accumulation ($2.8B+ inflows) |

| Macro Tailwinds | U.S.-EU trade deal reducing systemic risk |

Risks include overbought RSI and potential whale distribution. The $1M long-term 'pump and consolidate' scenario remains plausible but requires sustained institutional adoption.